Loading

Get Form Il-1040 - Illinois Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form IL-1040 - Illinois Department Of Revenue online

Filling out Form IL-1040, the individual income tax return for Illinois, can be straightforward when you have the right guidance. This guide offers a step-by-step approach to help users complete the form accurately online.

Follow the steps to complete Form IL-1040 online efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

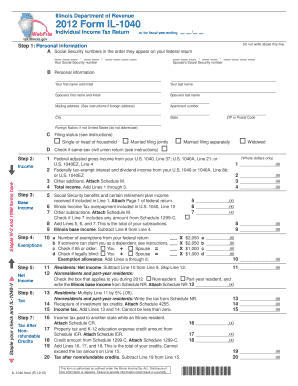

- Begin filling out the personal information section. Enter Social Security numbers in the order they are listed on your federal return, starting with your own followed by your spouse's. Then, provide your first name, middle initial, last name, and your spouse's name.

- Complete your mailing address. Ensure you include the apartment number if applicable, followed by the city, state, and ZIP code. If you have a foreign address, refer to the specific instructions provided.

- Select your filing status. This section allows you to choose from options such as single, married filing jointly, married filing separately, or widowed. If applicable, check the box for a same-sex civil union return.

- Proceed to the income section. Start with your federal adjusted gross income, follow this by any federally tax-exempt interest, and include other additions if applicable. Total the income in the designated field.

- Calculate net income. For residents, subtract any necessary lines according to the specific instructions outlined in the form.

- Determine your tax rate based on your calculated income. For residents, multiply your net income by the corresponding tax percentage. Nonresidents will need to refer to Schedule NR.

- Fill out credits applicable to your situation, including income tax paid to another state and any property tax or K-12 education expense credits.

- In the subsequent sections, provide the number of exemptions, calculate the exemption allowance, and ensure to staple any required W-2 or 1099 forms to the document.

- Lastly, review your payment details and refund options. Enter any Illinois income tax withheld and total your payments and potential refundable credits.

- Sign and date the form where indicated, ensuring the accuracy of the information provided. If someone else prepared the form, they should also sign off.

- After completing the form, you can save changes, download a copy for your records, print it for mailing, or share it as needed.

Complete your Form IL-1040 online today to ensure timely filing and avoid penalties.

When filing your Form IL-1040 - Illinois Department Of Revenue, you should attach any necessary schedules and forms that report specific income or deductions you are claiming. This typically includes copies of your W-2s and any additional documentation for deductions. Ensure all attachments are organized and legible to avoid processing delays.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.