Loading

Get Illinois Form Rr374

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois Form Rr374 online

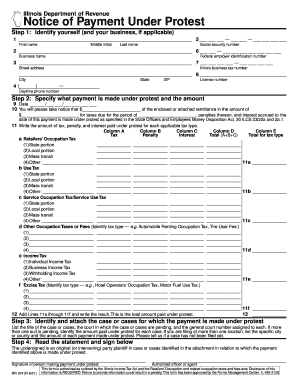

The Illinois Form Rr374 is a critical document used to record payments made under protest regarding taxes. This guide provides clear instructions on completing this form online, ensuring users can accurately submit their information without confusion.

Follow the steps to complete the Illinois Form Rr374 online.

- Click the ‘Get Form’ button to access the form and open it for filling out.

- Begin by identifying yourself and your business, if applicable. Enter your first name, middle initial, last name, and social security number. If you are representing a business, include the business name and its federal employer identification number.

- Next, provide the necessary address information. Fill in your street address, city, state, ZIP code, and your Illinois business tax number. Additionally, include your daytime phone number for contact purposes.

- Specify the date of payment under protest. Write the date in the provided format. Indicate the amount you are paying under protest in the designated section, detailing the tax period it pertains to, along with any penalties or interest associated with this remittance.

- In the subsequent fields, list the amount of tax, penalty, and interest for each applicable tax type. Complete each column for Retailers’ Occupation Tax, Use Tax, Service Occupation Tax, and other occupation taxes or fees, providing a subtotal for each tax type in the designated spaces.

- Summarize the total amount under protest by adding the amounts listed in the previous step. Write the total sum in the specified box at the end of the calculation section.

- Identify and attach details of the case or cases for which the payment has been made under protest. Include the title of each case, the court where it is pending, and the general court number. If applicable, indicate the amount connected to each case.

- Finally, read the statement carefully and provide your signature in the space designated for the person making the payment. If submitting on behalf of an organization, an authorized officer or agent must also sign the document.

Complete documents online efficiently and accurately.

To mail your Illinois tax return, print and complete the necessary forms, including the Illinois Form Rr374 if required. Place your return in a standard envelope and address it to the appropriate location specified by the Illinois Department of Revenue. Be sure to check that you have included all necessary documents and forms to avoid delays. It's also wise to send your return via certified mail for tracking purposes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.