Loading

Get Georgia Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Georgia Notice Of Dishonored Check - Civil - Keywords: Bad Check, Bounced Check online

Filling out the Georgia Notice Of Dishonored Check is an essential step for addressing issues related to bounced checks. This guide will provide you with the necessary steps to complete the form accurately and effectively.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

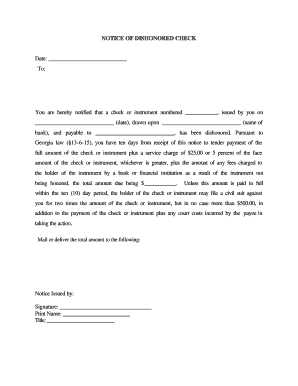

- Begin by filling in the 'Date' section at the top of the form, indicating the date you are notifying the individual of the dishonored check.

- In the 'To' section, specify the name of the person or entity that needs to be notified regarding the dishonored check.

- Enter the 'Check or instrument numbered' that corresponds to the dishonored check, providing the specific number to ensure accurate identification.

- Fill out the 'issued by you on' field with the exact date the check was written.

- In the 'drawn upon' section, note the name of the bank where the check was issued.

- Complete the 'payable to' line by stating the name of the individual or business to whom the check was made out.

- Calculate the total amount due by adding the face amount of the check, the applicable service charge of $25.00 or 5 percent of the face amount (whichever is greater), and any additional fees incurred by the bank due to non-honor of the instrument. Enter this total in the designated field.

- Make sure to inform the recipient that they have ten days from receipt of this notice to make payment to avoid further penalties.

- In the 'Notice Issued by' section, provide your signature, print your name, and indicate your title.

- Once you have completed all sections, review your form for accuracy, and ensure all necessary information is included.

- Finally, save your changes, and proceed to download, print, or share the completed form as required.

Take action now and fill out your documents online to manage your legal obligations efficiently.

If someone pays you a bounced check, it’s essential to remain calm and take proactive steps. First, contact the issuer to notify them about the bounced check. You may then initiate the process of sending a formal Georgia Notice of Dishonored Check to inform them of the legal implications. If the situation isn't resolved, consider consulting a legal professional for guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.