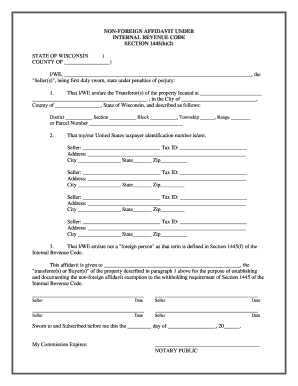

Get Wisconsin Non-foreign Affidavit Under Irc 1445

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wisconsin Non-Foreign Affidavit Under IRC 1445 online

Filling out the Wisconsin Non-Foreign Affidavit Under IRC 1445 is an essential step for transferring property and ensuring compliance with tax regulations. This guide provides clear, step-by-step instructions to help you complete the form online with ease.

Follow the steps to complete the affidavit online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by filling out your full name or the names of all sellers in the designated field as 'I/WE'. Ensure accuracy to avoid potential issues.

- Provide the address of the property being transferred, including the city, county, and state. Ensure all fields related to the property's location are filled accurately to reflect ownership.

- Detail the property's specifications by filling in the district, section, block, township, and range, or include the parcel number when applicable. This information helps identify the property accurately.

- Provide each seller's United States taxpayer identification number. Fill in all required fields for each seller, including their addresses, cities, states, and zip codes.

- Confirm that you are not a 'foreign person' as defined by Section 1445(f) of the Internal Revenue Code. This legal affirmation is crucial for establishing exemption from withholding requirements.

- Indicate the name of the buyer(s) or transferee(s) for whom this affidavit is being provided. This must match the buyer’s identity accurately for legal purposes.

- Sign and date the affidavit in the spaces provided for each seller. Ensure all sellers have signed and dated the form to validate the document.

- Have the affidavit notarized. A notary public must sign and date the form, confirming the authenticity of the signatures.

- Finally, save your changes, and consider options to download, print, or share the completed form based on your needs.

Complete your Wisconsin Non-Foreign Affidavit Under IRC 1445 today to streamline your property transfer process.

A foreign person under FIRPTA includes any individual or entity that does not meet the criteria to be treated as a United States person under section 7701 of the IRS code. Understanding this classification is crucial for property transactions involving foreign sellers. By completing a Wisconsin Non-Foreign Affidavit Under IRC 1445, sellers can assert their status and navigate these regulations with confidence.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.