Loading

Get Release Of Mortgage Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Release Of Mortgage Form online

Filling out the Release Of Mortgage Form online can simplify the process of formally releasing a mortgage obligation. This guide provides clear, step-by-step instructions to help users navigate each section of the form effectively.

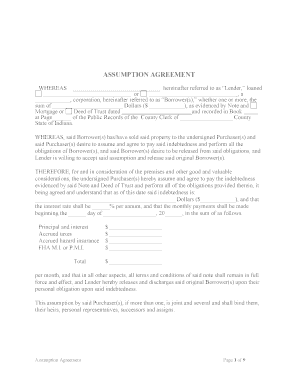

Follow the steps to complete the form accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the 'Lender' section. Enter the full name of the lender providing the mortgage release. This identifies the entity that originally extended the loan.

- In the 'Borrower(s)' section, fill in the name(s) of the individual(s) or the corporation that borrowed the funds. Include as many lines as necessary for multiple borrowers.

- Complete the loan amount section by entering the dollar amount of the mortgage that is being released.

- Indicate the date the original mortgage or deed of trust was executed, as well as where it was recorded, including book and page numbers in the public records.

- In the section pertaining to new purchasers, enter the names of the individuals or corporations assuming the mortgage obligations.

- Complete the portion detailing the debt being assumed, including the total indebtedness amount and the interest rate.

- Detail the payment structure for the mortgage, listing principal and interest, accrued taxes, insurance, and total monthly payments.

- In the signature and witness sections, ensure that all parties involved—including borrowers, lenders, and purchasers—sign appropriately, with witnesses present as required.

- After completely filling out all sections, save your changes. You will have options to download, print, or share the form as needed.

Complete your documents online with ease and confidence.

Related links form

Filling out a mortgage form requires attention to detail and accurate information. Start by clearly identifying the mortgage type and property involved, and then include your personal details and financial information as requested. When completing a Release Of Mortgage Form, make sure to double-check each part for accuracy to avoid delays in processing. It’s helpful to refer to any examples or guidelines provided by the form issuer to ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.