Get Louisiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Louisiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other online

Filling out the Louisiana Fiduciary Deed can seem daunting, but with the right guidance, you can complete it efficiently. This guide will provide you with clear, step-by-step instructions to help you fill out the form online, ensuring all necessary components are addressed.

Follow the steps to accurately complete your fiduciary deed

- Click ‘Get Form’ button to obtain the form and open it in the editor.

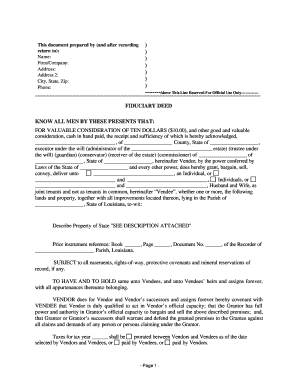

- Begin by filling in the preparer's information at the top of the form. Include your name, firm or company, address, city, state, zip code, and phone number. This identifies who prepared the deed.

- Proceed to the section titled 'FIDUCIARY DEED' and state the parties involved. Provide the name of the vendor, the county and state from which they are acting, and reference their capacity such as executor, trustee, administrator, etc.

- In the line following 'FOR VALUABLE CONSIDERATION OF TEN DOLLARS ($10.00)', ensure to confirm the receipt of any consideration for the deed. Fill in the details regarding the estate the vendor is associated with.

- Next, specify the vendees (the individuals receiving the property) in the appropriate format. Include individual names or relationship statuses, ensuring compliance with the aforementioned neutral language guidelines.

- Clearly describe the property being transferred. Use 'SEE DESCRIPTION ATTACHED' if you have a separate document detailing the property description.

- Complete the prior instrument reference section, noting the book number, page number, and document number from the recorder's office that pertains to this property.

- Under the Taxes section, clarify how taxes are to be handled between vendors and vendees. Check the relevant option leading up to your arrangement on tax responsibilities.

- Finalize the deed by signing and dating it in the presence of witnesses. Ensure that two witnesses sign the document.

- Engage a notary public to notarize the deed, indicating the date of notarization and the notary's signature, ensuring official acknowledgment of the document.

- After completing the deed, save your changes. You may then download, print, or share the form as needed.

Start completing your documents online now and ensure all steps are followed correctly.

Related links form

Fiduciaries and trustees are closely related, but they are not the same. All trustees are fiduciaries, but not all fiduciaries are trustees. The term fiduciary encompasses various roles that require trust and responsibility, while the trustee specifically refers to an individual managing a trust under a Louisiana Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.