Get Massachusetts Non-foreign Affidavit Under Irc 1445

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Massachusetts Non-Foreign Affidavit Under IRC 1445 online

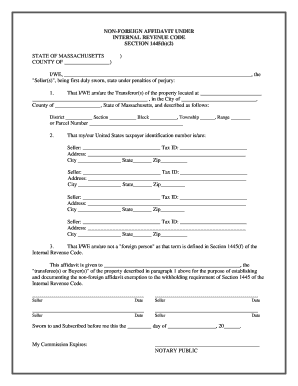

Completing the Massachusetts Non-Foreign Affidavit Under IRC 1445 is an essential step for sellers in real estate transactions who are not considered foreign persons. This guide provides clear, step-by-step instructions for filling out the form online, ensuring you understand each component and requirement involved.

Follow the steps to complete the Massachusetts Non-Foreign Affidavit Under IRC 1445 online

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- In the first section, provide your full name as the seller or sellers, ensuring accuracy to avoid any complications.

- Enter the details of the property you are transferring, including the address and description of the property. Be thorough in describing the district, section, block, township, range, or parcel number.

- Fill in your United States taxpayer identification number, along with the corresponding address, city, state, and zip code for each seller listed. Make sure all tax identification numbers and contact details are correct.

- Confirm that you and any co-sellers are not classified as 'foreign persons' under the Internal Revenue Code by marking the appropriate section.

- Designate the transferee or buyer’s name clearly to indicate who the affidavit is intended for.

- Sign and date the affidavit, ensuring all sellers sign where indicated, with signatures placed beside their printed names.

- Finalize the document by indicating the date it is sworn and subscribed before a notary public, who will also sign and provide their commission expiration date.

- After you have filled out the form, save your changes and choose the option to download or print the document for your records. You may also share the completed affidavit as necessary.

Start completing your Massachusetts Non-Foreign Affidavit Under IRC 1445 online today.

To avoid FIRPTA withholding tax, sellers should ensure they are classified as non-foreign persons. By submitting a Massachusetts Non-Foreign Affidavit Under IRC 1445, sellers can easily establish this status to avoid unnecessary taxes on their property sale. Consulting with a tax professional can provide additional guidance in navigating these requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.