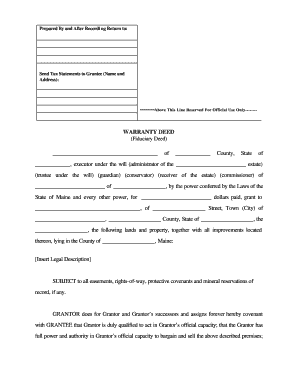

Get Maine Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Maine Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries online

Filling out the Maine Fiduciary Deed is a crucial task for fiduciaries seeking to transfer property efficiently and legally. This guide provides comprehensive steps to assist you in completing the deed online, ensuring all necessary details are accurately recorded.

Follow the steps to fill out the Maine Fiduciary Deed online.

- Click ‘Get Form’ button to obtain the form and access it in your preferred editing program.

- Begin by identifying the grantor. Fill in the name of the executor, administrator, trustee, guardian, or other fiduciary roles as applicable in the designated space.

- Complete the details regarding the estate or trust by entering the decedent’s name or the title of the trust, as indicated in the form.

- Specify the county and state related to the property being conveyed in the appropriate sections.

- Indicate the amount paid for the property in the 'dollars paid' section. Ensure this figure is accurate and clearly stated.

- Enter the complete name and address of the grantee, including street, city or town, county, and state, making sure all information is precise.

- Provide a legal description of the property to be transferred in the indicated space, ensuring it matches public records.

- Review and check any applicable conditions or clauses, particularly regarding easements or covenants that might affect the transfer.

- Fill in details for tax responsibilities for the current year, selecting the appropriate payment responsibility.

- If the grantees are married, ensure the correct form of ownership is specified, either as joint tenants or tenants in common.

- Date and sign the document where indicated, including spaces for witnesses, and ensure that all required signatures are completed.

- Finally, save your changes, download a copy in your preferred format, and print the completed deed for submission.

Complete your fiduciary deeds online today and ensure your documents are accurately prepared for legal transfer.

A quitclaim deed without covenant in Maine transfers property with no promises or warranties about the title. This means the grantor does not guarantee that they have the legal right to transfer the property. For those acting as fiduciaries, using a Maine Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries can provide more security and assurance for the involved parties during property transactions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.