Get 587cagov Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 587cagov Form online

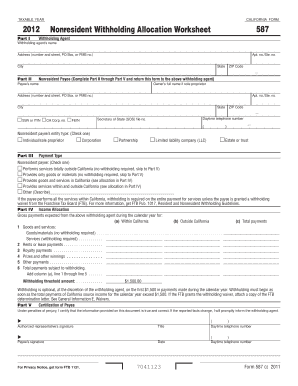

Completing the 587cagov Form online is a straightforward process designed for users to accurately report withholding allocations for nonresidents. This guide provides clear instructions to help you effectively navigate and fill out the form.

Follow the steps to complete the 587cagov Form online.

- Click 'Get Form' button to obtain the essential form and open it in your preferred digital platform.

- In Part I, enter the withholding agent's name and address including the apartment number, city, state, and ZIP code.

- Move to Part II to fill in the details of the nonresident payee. This includes the payee's name, owner's full name if applicable, address, and either the SSN, ITIN, CA Corp. number, or FEIN.

- Next, identify the type of nonresident payee by checking the appropriate box that classifies the entity (individual, corporation, partnership, etc.).

- In Part III, select the correct payment type by checking the box that corresponds with the services or goods provided. Note any options that state if withholding is required.

- Proceed to Part IV for income allocation. Fill in the expected gross payments from the withholding agent, specifying amounts rendered within and outside of California.

- In Part V, both the authorized representative and payee must sign and date the form. Ensure that all information provided is accurate and truthful.

- Finally, review the completed form for any errors or missing information. Once confirmed, you can save changes, download, print, or share the form as needed.

Complete your 587cagov Form online today for a smooth and efficient filing experience.

In California, withholding tax is typically required from sellers whose properties are sold, particularly for nonresidents. The process includes completing specific forms and submitting them to the state, ensuring compliance with tax regulations. This requirement is designed to ensure that the state receives tax revenue from property sales involving nonresidents. By using the 587cagov Form and consulting with platforms like uslegalforms, you can navigate this process efficiently and ensure all your obligations are met.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.