Loading

Get Irs Revenue Procedure 2002 69 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Revenue Procedure 2002 69 Form online

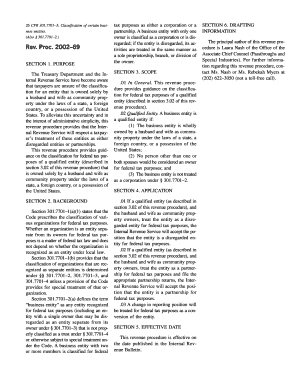

Filling out the Irs Revenue Procedure 2002 69 Form online can be straightforward with the right guidance. This form addresses the classification of entities owned solely by a married couple as community property for tax purposes.

Follow the steps to complete the form effectively

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Review the form to understand the sections related to the classification of your entity. Familiarize yourself with the definitions provided within the form regarding 'qualified entity' and 'disregarded entity'.

- In the first section, provide your full name and the name of your business entity. Ensure that the information matches the records maintained by the IRS.

- Indicate your ownership status by checking the appropriate box if the business entity is solely owned by you and your partner as community property. This is crucial for determining the classification.

- In the subsequent sections, specify whether you are treating the entity as a disregarded entity or as a partnership. Attach any necessary documentation that supports your classification choice.

- Double-check all fields for accuracy and completeness. Incorrect information may lead to processing delays or misclassification.

- Once all sections are filled out and verified, save your changes. You can then download, print, or share the form as needed for submission.

Start filling out your forms online today to ensure timely and accurate processing.

You should file IRS form 8806 when you need to report certain transactions that fall under the IRS Revenue Procedure 2002 69 form. This includes specific circumstances that involve reporting partnerships or joint ventures. Filing on time ensures that you comply with legal obligations and avoids potential penalties. Make sure to check the IRS guidelines for more detailed instructions on deadlines and requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.