Loading

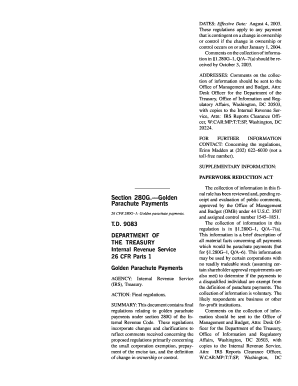

Get 280g Nonresident Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 280g Nonresident Form online

The 280g Nonresident Form is essential for businesses and individuals who need to report specific payments made to nonresident individuals. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring a smooth filing process.

Follow the steps to fill out the 280g Nonresident Form correctly.

- Click ‘Get Form’ button to download the 280g Nonresident Form and open it in your preferred document editor.

- In the first section, enter your personal information such as your name, address, and taxpayer identification number (if applicable). Ensure all information is accurate to avoid processing delays.

- Next, review the specific provisions related to golden parachute payments. Understand the amounts that may qualify under this regulation and prepare to detail these in the subsequent fields.

- Fill out the sections regarding the amounts reported as parachute payments. This includes specifying the total compensation and providing any necessary breakdowns related to each payment.

- If applicable, include information on any reasonable compensation for personal services that were rendered prior to the change in ownership or control.

- Review all entries for accuracy and completeness. Ensure that any necessary documentation supporting your entries is available.

- Once satisfied with your entries, options will be provided to save your changes, download the form, print, or share it digitally. Choose an appropriate action based on your filing preferences.

Complete your 280g Nonresident Form online today to ensure compliance with tax regulations.

The 280G form refers to the documentation required to assess parachute payments and ensure regulatory compliance during corporate transactions. This form helps identify any potential excess payments that would lead to tax penalties. Utilizing the 280G Nonresident Form correctly can facilitate smoother filing and accountability, protecting you from unforeseen tax issues.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.