Get Form 8917 For 2007

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8917 for 2007 online

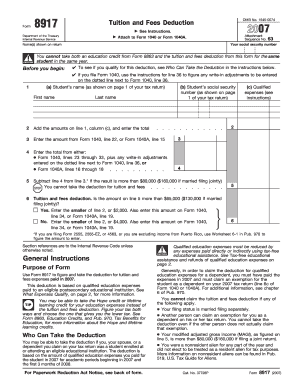

Filling out the Form 8917 for tuition and fees deduction can be a straightforward process when approached systematically. This guide provides a detailed walkthrough to help users complete the form accurately online.

Follow the steps to fill out the Form 8917 comprehensively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the names of the individuals as shown on your tax return. Ensure you complete the fields for the student's name and social security number exactly as listed.

- Next, locate line 2 and add the amounts from line 1, column (c) for each student to determine the total qualified expenses.

- Continue to line 3 where you will enter the amount found on Form 1040, line 22, or Form 1040A, line 15.

- Proceed to line 4 and enter the total amounts from Form 1040, lines 23 through 33, including any write-in adjustments as described in the instructions.

- Subtract the amount from line 4 from the amount on line 3. If the result exceeds $80,000 (or $160,000 for married filing jointly), stop; you cannot claim this deduction.

- For line 5, determine if the amount exceeds $65,000 (or $130,000 for married filing jointly). If yes, enter the lesser of line 2 or $2,000; if no, enter the smaller of line 2 or $4,000.

- After completing all calculations, review the entire form for accuracy, and proceed to save changes, download, print, or share the form as needed.

Complete your documents online today for a smoother filing experience.

Form 8917 for 2007 is a tax form that allows eligible taxpayers to claim a deduction for qualified tuition and related expenses. By using this form, individuals can potentially lower their taxable income, which may lead to tax savings. To complete Form 8917 for 2007, you need to provide information about your educational expenses and the institution you attended. Consider using US Legal Forms to access the necessary documentation and guidance for filing this form effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.