Get Form 712 From 1992

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 712 From 1992 online

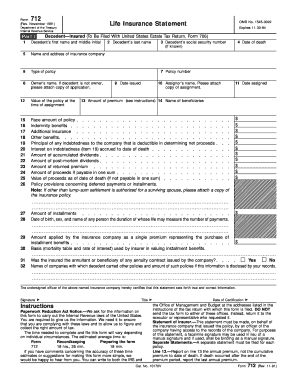

Filling out the Form 712, also known as the Life Insurance Statement, is essential for reporting life insurance policies as part of the United States estate and gift tax returns. This guide provides clear, step-by-step instructions to help you navigate the process online, ensuring each section is completed accurately.

Follow the steps to complete Form 712 online with ease.

- Click ‘Get Form’ button to access the document digitally and open it in your preferred platform.

- In Part I, fill in the decedent's first name and middle initial in box 1, followed by their last name in box 2, and social security number in box 3, if known. Enter the date of death in box 4.

- Provide the name and address of the insurance company in box 5, and specify the type of policy in box 6. Fill in the policy number in box 7, and the date issued in box 9.

- For ownership details, enter the owner's name in box 8. If the decedent was not the owner, attach a copy of the relevant application.

- Continue filling in boxes 10 to 13 with the assignor's name, date assigned, value of the policy at the time of assignment, and the amount of premium respectively.

- Complete boxes 14 to 26 with details regarding beneficiaries and various insurance values, including the face amount, indemnity benefits, and any indebtedness.

- For boxes 27 to 30, document amounts related to installments and any relevant policy information, ensuring clarity in each entry.

- Finalize Part II by completing the sections for living insured with the donor's or decedent's information in boxes 33-37, and move to policy information in sections B, filling in details regarding the insured and insurance company.

- Once all sections are filled, review the entire form for accuracy. Users can then save changes, download, print, or share the form as needed.

Begin the process of completing your documents online today to ensure accuracy and compliance.

Form 712 is specifically used to report life insurance information to the IRS for estate tax purposes. It helps ensure that all applicable life insurance proceeds are included in the total estate value. This filing is critical when calculating estate taxes owed after a death. Utilizing Form 712 From 1992 accurately will smooth the estate settlement process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.