Loading

Get 1993 Form 8606

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1993 Form 8606 online

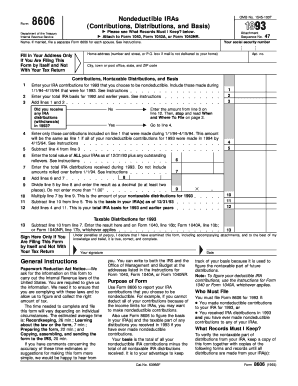

Filing the 1993 Form 8606 is essential for reporting nondeductible IRA contributions and determining the basis for your IRA accounts. This guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to fill out the 1993 Form 8606 online.

- Click 'Get Form' button to obtain the form and open it in the online editor.

- Enter your full name and home address as required in the designated fields. If you are completing this form by itself, only fill in your address.

- Provide your social security number in the space provided. Ensure it is accurate to avoid processing delays.

- Complete section 1 by entering your nondeductible IRA contributions for 1993. If you contributed during the first few months of 1994 specifically for 1993, include those amounts.

- In section 2, input your total IRA basis from prior years. This should reflect your contributions from 1992 and earlier.

- Add the amounts from lines 1 and 2 in section 3 and record the total amount in line 3.

- In section 4, indicate if you received any IRA distributions in 1993 by selecting 'Yes' or 'No'. If 'Yes,' proceed with the next steps; otherwise, skip to line 12.

- If you selected 'Yes,' follow the next instructions to calculate the nontaxable distributions and your basis in the IRA as of 12/31/93 by completing the subsequent lines.

- After filling out all applicable sections, review your entries for accuracy.

- Once everything is completed, save your changes in the online editor. You will have options to download, print, or share the completed Form 8606 as needed.

Complete your Form 8606 online today to ensure your IRA contributions are reported correctly.

Related links form

Yes, you can file the 1993 Form 8606 for previous years if you did not do so at the time of your tax return. It's important to report any nondeductible contributions retroactively to avoid issues with the IRS. Consider using uslegalforms to guide you through filing these past forms accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.