Get Form 5754

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5754 online

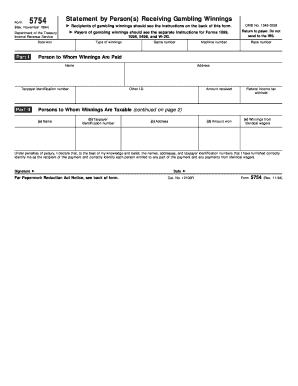

Form 5754 is essential for individuals receiving gambling winnings, whether on behalf of others or as part of a group. This guide will help you navigate the process of completing the form online, ensuring you provide all necessary information correctly.

Follow the steps to fill out the Form 5754 online with ease

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- In Part I of the form, fill in your name, address, and taxpayer identification number. If winnings are from state-conducted lotteries, you may leave the 'Other I.D.' box blank.

- Enter the total amount you received in the 'Amount received' field. Additionally, provide the total federal income tax withheld in the designated section.

- Proceed to Part II to identify all individuals entitled to a share of the winnings. If you are among them, start by entering your information in the first row of Part II. Write 'Same as above' in columns (a), (b), and (c) and fill in the amounts won in columns (d) and (e).

- For each additional winner, complete columns (a) through (e) with their name, taxpayer identification number, address, amount won, and winnings from identical wagers.

- Ensure all information is accurate. If federal income tax has been withheld, sign and date the form at the bottom. If no tax is withheld, a signature is not necessary.

- After completing the form, save your changes and download a copy for your records. You can then print or share the form as needed.

Start filling out your Form 5754 online today to ensure your gambling winnings are properly reported.

Related links form

Yes, you can still file your taxes without a W2G, but it may complicate your reporting. In this case, you should consider using Form 5754 to allocate winnings properly if you were a member of a group that won a prize. Form 5754 helps divide the winnings among participants, allowing you to report your share accurately. It’s essential to keep accurate records of your winnings for your tax return.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.