Loading

Get 10 95

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 10 95 online

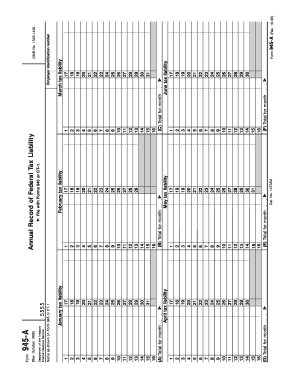

Filing Form 10 95 online is essential for employers to report federal tax liabilities accurately. This comprehensive guide provides user-friendly instructions to help individuals complete the form effectively.

Follow the steps to fill out the 10 95 online seamlessly.

- Use the ‘Get Form’ button to obtain the 10 95 form and open it in your preferred online document editor.

- Enter your name as it appears on Form 10 95 or CT-1 in the designated field labeled ‘Name as shown on Form 945 or CT-1.’

- For each month of the year, provide the corresponding tax liability amounts. Begin with January in line 17, followed by the respective total liability for each subsequent month through December.

- Ensure that the monthly totals for each month, labeled (A) through (L), are accurately calculated and reported.

- At line (M), calculate the total tax liability for the year by adding lines (A) through (L). This number should match line 4 on Form 945 or line 18 on Form CT-1 for accurate filing.

- Review all entries for accuracy and completeness to avoid any issues during processing.

- Once you have confirmed that all information is correct, you can save changes, download, print, or share the completed form as needed.

Complete your 10 95 filing online today to ensure accurate tax reporting.

If you don't have a 1095-A, you should first contact your health insurance marketplace. They can provide a copy of the form, which is essential when filing your tax return. Not having a 1095-A doesn't eliminate your obligations; however, uslegalforms offers tools and guidance to help you navigate the tax process even without this form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.