Loading

Get Form 940 For 1996

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 940 for 1996 online

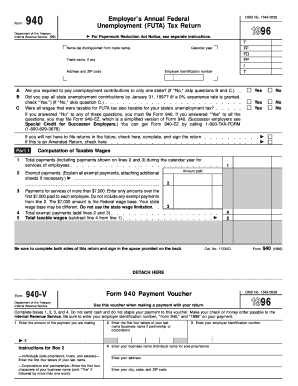

Filling out the Form 940 for 1996 is essential for employers to report their annual Federal Unemployment Tax Act (FUTA) tax. This guide provides step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to complete the Form 940 for 1996 online

- Click the 'Get Form' button to access the Form 940 for 1996 and open it in your online editor.

- Fill in your name and trade name (if applicable) along with your address and ZIP code. Ensure that the information is accurate to avoid any delays.

- Enter your employer identification number (EIN) to identify your business.

- Answer the questions regarding your unemployment contributions: Are you required to pay contributions to only one state? Did you pay all state unemployment contributions by January 31, 1997? Were all taxable wages for FUTA also taxable for your state’s unemployment tax?

- Complete Part I by calculating your taxable wages. Total all payments made for services of employees during the year and indicate any exempt payments.

- In Part II, calculate total FUTA tax based on your taxable wages. Include the gross tax, maximum credit, and any balances due or overpayment.

- For Part III, complete the record of quarterly federal unemployment tax liability and declare the accuracy of your return by signing in the appropriate section.

- After completing the form, review all entries for accuracy before saving your changes. You can then download, print, or share the completed Form 940 as needed.

Start filling out your Form 940 online today to ensure compliance and assess your unemployment tax obligations effectively.

To find previously filed 940 and 941 forms, you can access them through your IRS online account, if applicable. Additionally, tax software may retain records of your submissions. If you used a service like US Legal Forms, consider reaching out to them for assistance in locating these forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.