Get Form 8606 1983

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8606 1983 online

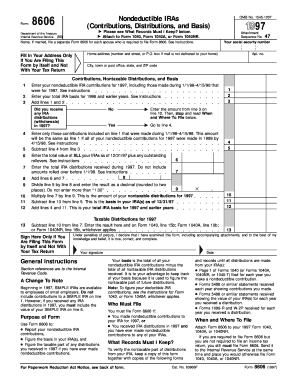

Filling out the Form 8606 is essential for reporting nondeductible IRA contributions and calculating the taxable portion of distributions. This guide provides step-by-step instructions to help users complete the form accurately and efficiently online.

Follow the steps to complete the form seamlessly.

- Press the ‘Get Form’ button to access the document and open it in the designated online editor.

- Begin by entering your name. If you are married, ensure to fill out a separate Form 8606 for your partner who is required to file this form.

- Provide your home address. If you are filing this form independently and not with your tax return, include your complete address.

- Input your social security number in the designated field.

- Enter your nondeductible IRA contributions for the tax year indicated, including contributions made during the specified timeframe.

- Record the total IRA basis for previous years as required.

- Sum the amounts obtained in steps 5 and 6 and enter this total in the appropriate field.

- Respond to the question regarding whether you received any IRA distributions in the relevant year.

- If yes, proceed to calculate the contributions made in the defined timeframe and enter the calculated figures.

- Complete the calculations required for determining the nontaxable distributions and your IRA basis.

- After finishing all entries, review the form for accuracy.

- Finally, you can choose to save the changes, download, print, or share the completed form.

Complete your Form 8606 online today to ensure accurate reporting of your IRA contributions.

Making a nondeductible IRA contribution can be a strategic move for individuals who exceed income limits for deductible contributions. This allows you to grow your retirement savings in a tax-advantaged account. Additionally, using Form 8606 1983 ensures that you track your basis for future withdrawals, protecting you from paying taxes twice on the same funds. It is a valuable option for retirement planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.