Loading

Get Form 8862

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8862 online

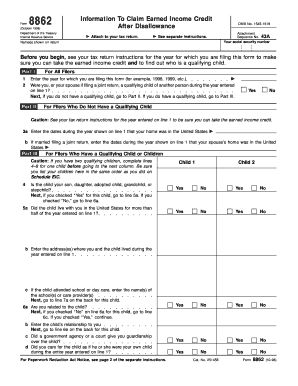

Form 8862 is used to claim the earned income credit after disallowance. Completing this form accurately is essential to ensure you receive the credit you are eligible for, especially if you have had your credit denied previously.

Follow the steps to fill out Form 8862 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the year for which you are filing Form 8862 in the designated field.

- Indicate whether you or your spouse, if filing jointly, were a qualifying child of another person during the year entered on line 1 by selecting 'Yes' or 'No'.

- If you don't have a qualifying child, proceed to Part II. Enter the dates during the year your home was in the United States.

- For those with a qualifying child, confirm the child's relationship to you and provide information about their residency, including their address and any schooling they attended.

- Continue to answer the questions in Part III regarding the child's living situation and whether you have had guardianship.

- Once all sections have been completed, review your entries for accuracy and completeness.

- You can then save the changes, download, print, or share the completed form as needed.

Complete your Form 8862 online to ensure your eligibility for the earned income credit.

You are required to fill out Form 8862 to re-establish your eligibility for certain tax credits after a previous disallowance. This form allows you to provide the necessary documentation and information to the IRS. Filling it out correctly is crucial for receiving benefits that you are entitled to.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.