Loading

Get Irs Form 8860

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 8860 online

Filling out the Irs Form 8860 online can streamline the process of claiming the qualified zone academy bond credit. This guide provides clear and straightforward instructions to help you navigate each section of the form effectively.

Follow the steps to fill out the form with ease.

- Press the ‘Get Form’ button to access the form and open it in your selected platform.

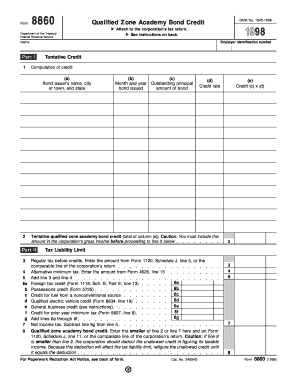

- Enter the corporation's name and employer identification number at the top of the form.

- Proceed to Part I. In line 1, provide the bond issuer's name, city or town, and state in column (a). In column (b), indicate the month and year the bond was issued. Fill in column (c) with the outstanding principal amount of the bond.

- In column (d), enter the credit rate, which is 110% of the long-term applicable federal rate for the month and year the bond was issued.

- Calculate the credit in column (e) by multiplying the amounts from column (c) and column (d). The total amount from column (e) will be entered on line 2.

- Move to Part II. On line 2, enter the amount of regular tax before credits from Form 1120, Schedule J, line 3. If applicable, also provide the alternative minimum tax amount from Form 4626, line 15 on line 4.

- Add the amounts from line 3 and line 4 and enter the total on line 5. Next, provide any relevant credits on lines 6a through 6f, summing all applicable credits in line 6g.

- Subtract line 6g from line 5 to determine the net income tax on line 7.

- On line 8, enter the smaller amount between line 2 and line 7. Ensure this is also reported on Form 1120, Schedule J, line 11.

- Once all fields are completed and checked for accuracy, you can save your changes, download a copy, print the form, or share it as needed.

Complete your Irs Form 8860 online today and streamline your tax credit process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Whether you need to file Form 8960 depends on your total income and whether it surpasses certain thresholds for net investment income. If you have substantial investment income, filing this form becomes important to avoid penalties. It's wise to analyze your financial situation closely and consult with resources like US Legal Forms if you're unsure about your requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.