Get Form 6781

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 6781 online

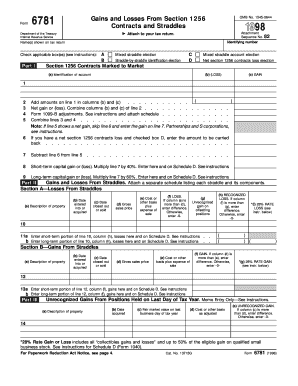

Form 6781 is essential for reporting gains and losses from Section 1256 contracts and straddles. This guide provides simple, step-by-step instructions to help users accurately complete this form online, ensuring compliance and ease in the filing process.

Follow the steps to effectively complete Form 6781.

- Click ‘Get Form’ button to access the form online and open it for editing.

- Begin by reviewing the identification section. Enter your name(s) as shown on your tax return and your identifying number in the appropriate fields. This information is crucial for processing your return accurately.

- In Part I, examine the mixed straddle elections. Select the applicable boxes regarding elections you've made concerning straddles. These choices will determine how your funds are allocated for tax purposes.

- Proceed to list each section 1256 contract. Record the identification of your accounts, losses, and gains accurately in columns (a), (b), and (c). Ensure summation reflects accurately in subsequent lines.

- For any losses indicated, refer to the specific instructions for adjusting based on Form 1099-B. Document all necessary adjustments according to your straddle transactions.

- Carefully complete Parts II and III, ensuring all gains and losses are noted, along with their descriptions, dates, and amounts. This documentation must align with your trading activities and recognized losses.

- After inputting all required information, check for completeness and accuracy. Make necessary edits to ensure the form is correctly completed.

- Once finalized, proceed to save your changes. You have the option to download, print, or share the completed Form 6781 as required for filing.

Start filling out your documents online to ensure a smooth filing process.

Related links form

O termo 'tax' refere-se a uma cobrança imposta pelo governo sobre a renda, propriedade ou vendas. Essas cobranças são essenciais para financiar serviços públicos e infraestruturas. O Form 6781, por exemplo, é um documento utilizado para declarar ganhos e perdas relacionadas a transações tributárias. Compreender o conceito de 'tax' é fundamental para gerenciar suas obrigações financeiras, e a plataforma US Legal Forms pode auxiliá-lo a se manter em dia com suas declarações.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.