Loading

Get 5304 Simple Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 5304 Simple Pdf online

This guide provides a comprehensive overview of how to properly fill out the 5304 Simple Pdf online. Designed for users at all experience levels, this document management resource will help you navigate each section of the form with ease and confidence.

Follow the steps to fill out the 5304 Simple Pdf online.

- Click the ‘Get Form’ button to obtain the document and open it in your online editor.

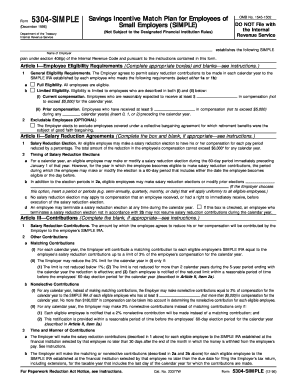

- In Article I, select the appropriate eligibility requirements for your employees. Choose either full eligibility (1a) or limited eligibility (1b). If selecting limited eligibility, fill in the blanks for current and prior compensation amounts.

- For Article II, provide the required salary reduction election details. Fill out the percentage or dollar amount an eligible employee wishes to contribute from each pay period.

- Complete Article III regarding contributions. Specify whether you will be making matching or nonelective contributions and fill in the necessary compensation amounts and limits.

- In Article IV, confirm the general requirements for contributions and any restrictions that apply. Ensure that all necessary boxes are checked.

- For Article V, clearly define ‘compensation’ as it applies to employees and ensure to cover definitions around contributions.

- In Articles VI and VII, finalize the withdrawal procedures and insert the effective date of the SIMPLE plan.

- Once all sections are complete, review the document for accuracy, and then save your changes, download, print, or share the form as needed.

Begin filling out your documents online today for a smoother process.

No, you cannot contribute 100% of your salary to a SIMPLE IRA. The IRS sets specific limits on contributions to prevent excessive funding. For a thorough understanding of contribution limits and effective retirement planning, the 5304 Simple Pdf is an excellent resource to reference.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.