Loading

Get Sale Of Exchange Property Form 4797

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sale Of Exchange Property Form 4797 online

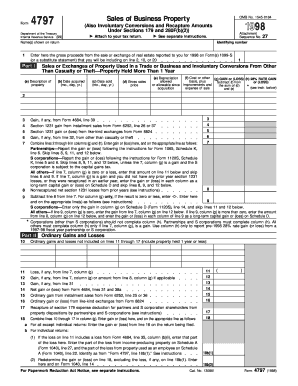

Filling out the Sale Of Exchange Property Form 4797 is an essential step for individuals and entities reporting sales and exchanges of property used in a trade or business. This guide will help you navigate the online process of completing this form with ease and confidence.

Follow the steps to complete the Sale Of Exchange Property Form 4797 online

- Click ‘Get Form’ button to obtain the form and open it in your online document editor.

- Enter your name as it appears on your tax return in the designated field.

- Report the gross proceeds from the sale or exchange of real estate as noted on any Form 1099-S you have received. Place this amount in the appropriate section on the form.

- Proceed to Part I, where you will detail information regarding property sales or exchanges. For each property, provide the description, date acquired, date sold, gross sales price, depreciation, cost basis, gain or loss, and any applicable 28% rate gain.

- After filling out the necessary property details, calculate the gain or loss and document it according to the subsequent instructions regarding partnerships, S corporations, or individual reporting.

- Move to Part II to document any ordinary gains or losses not included previously. Fill in the required details such as losses, gains from other forms, and combine lines to report the overall gain or loss.

- In Part III, address the gains from disposals under specified sections. Ensure to detail each property’s sales price, cost, adjusted basis, and calculate the total gain or loss.

- Complete Part IV if there are recapture amounts under Sections 179 and 280F(b)(2). This will require inputting any prior year deductions and recomputed depreciation.

- Review all entered information for accuracy before proceeding to save, download, or print the completed form.

Complete your Sale Of Exchange Property Form 4797 online today for seamless document management.

Yes, capital gains from the sale of business property are reported on Form 4797. This form helps to determine the amount of gain that is taxable, particularly in relation to the property's depreciation. Understanding how to report these gains correctly can reduce potential tax burdens. For guidance, consider resources available at uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.