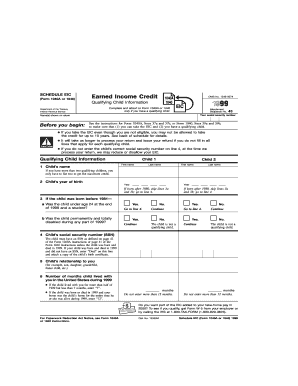

Get 1999 Form 1040 (schedule Eic). Earned Income Credit

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1999 Form 1040 (Schedule EIC). Earned Income Credit online

This guide provides clear and detailed instructions for completing the 1999 Form 1040 (Schedule EIC), which is used to claim the Earned Income Credit. By following these steps, users can ensure they accurately fill out the form online and maximize their credits.

Follow the steps to accurately complete your Schedule EIC.

- Click 'Get Form' button to access the 1999 Form 1040 (Schedule EIC) and open it for editing.

- Begin by entering your social security number and the names of any qualifying children on the form. Ensure the information matches the details you provided on your main tax return, Form 1040 or 1040A.

- For each qualifying child, fill in the required information including their name, year of birth, social security number, relationship to you, and the number of months they lived with you in the United States during 1999.

- Check the eligibility criteria for each child to ensure they qualify under the Earned Income Credit guidelines. Pay special attention to the age and residency requirements outlined in the instructions.

- Complete lines 3a and 3b only if applicable, confirming if the child was under age 24 and a student or permanently and totally disabled. If not applicable, proceed to the next line.

- Once all sections are filled out accurately, review your information for correctness. After ensuring all details are correct, you can save the changes, download a copy of the form, print it, or share it as needed.

Complete your 1999 Form 1040 (Schedule EIC) online today to take advantage of the Earned Income Credit.

To calculate your Earned Income Credit on the 1999 Form 1040, start by completing Schedule EIC, which will guide you through the necessary steps. You will need to input your total earned income and the number of qualifying children you have. The IRS provides tables that outline the credit amounts based on your income level and family size. Utilizing platforms like US Legal Forms can simplify this process by offering templates and resources to ensure accurate filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.