Loading

Get 1086 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1086 Form online

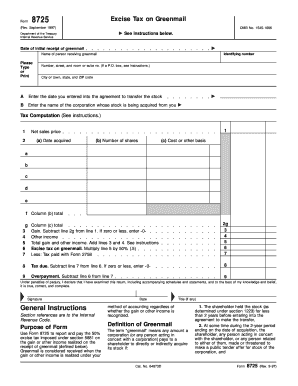

The 1086 Form, also known as Form 8725, is used to report and pay the excise tax on greenmail. This guide will provide you with clear, step-by-step instructions to help you complete the form online effectively.

Follow the steps to complete the 1086 Form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the date of initial receipt of greenmail in the designated field to acknowledge when you received the payment.

- Provide the name of the person receiving the greenmail and their identifying number in the respective sections. Make sure to print or type clearly.

- Fill in the address fields, including the street number, room or suite number, city or town, state, and ZIP code.

- In section A, enter the date you entered into the agreement to transfer the stock. This date is crucial for tax purposes.

- In section B, enter the name of the corporation from which the stock is being acquired.

- Complete the tax computation section. Start by entering the net sales price received from the stock sale.

- For each acquisition subject to excise tax, fill in the date acquired, number of shares, and cost or other basis in the respective columns. Ensure accuracy to avoid penalties.

- Calculate your gain by subtracting the relevant figures as instructed on the form. This will determine your total gain and other taxable income.

- Input the excise tax amount based on your calculated gain. Remember, this is typically 50% of the gain.

- If applicable, enter any tax previously paid on Form 2758. This will help in determining your tax liability on this form.

- Finally, review all entries for accuracy. You can save changes, download, print, or share the completed form as needed.

Encourage others to utilize this guide to complete their documents online with confidence.

The 20% rule for SBA refers to a guideline that mandates that at least 20% of a business's financing must come from funds other than SBA loans. This rule helps to encourage a diverse funding structure for small businesses. By complying with the 20% rule, you can enhance your eligibility for various SBA programs. Check out US Legal Forms for resources that clarify this rule further.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.