Loading

Get Form 4782

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4782 online

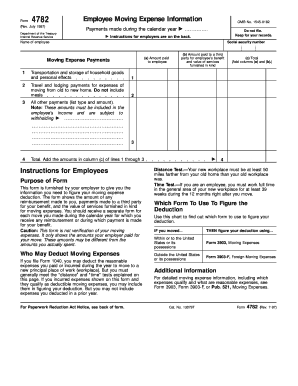

Form 4782 is designed to provide employees with information regarding moving expense reimbursements. This guide will walk you through the process of filling out the form online, ensuring you capture all necessary details accurately.

Follow the steps to complete Form 4782 with ease.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Enter the name of the employee in the designated field.

- Input the employee's social security number in the appropriate section.

- Record the amount paid to the employee for moving expenses in column (a) under the corresponding categories: transportation and storage, and travel and lodging.

- For payments made to third parties on behalf of the employee, enter these amounts in column (b).

- Calculate the total of columns (a) and (b) for each line and record the sums in column (c).

- List any other payments related to moving expenses in the designated section and ensure that these amounts are included in the employee's income.

- Add the amounts in column (c) of lines 1 through 3 to determine the overall total, filling it in the final line provided.

- Review all entries for accuracy, then save your changes. You may download, print, or share the completed form as necessary.

Take action now and complete your Form 4782 online!

Completing a W-2 form requires accurate reporting of wages, tips, and withheld taxes for your employees. Follow IRS guidelines for filling out each section correctly. Utilizing platforms like USLegalForms can provide you with templates and instructions, ensuring you complete the W-2 form efficiently and accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.