Loading

Get Notice 746

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notice 746 online

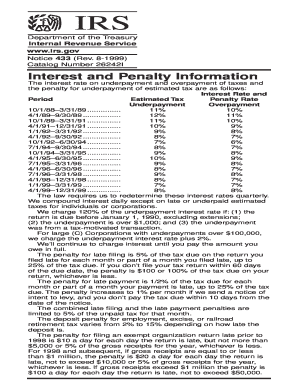

Filling out Notice 746 can seem daunting, but with a clear understanding of each section, the process can be straightforward. This guide will provide step-by-step instructions to help you successfully complete the form online.

Follow the steps to fill out Notice 746 online.

- Click the ‘Get Form’ button to acquire the form and open it in your chosen editor.

- Begin by entering your personal information in the designated fields, including your name, address, and identification number. Ensure that all details are accurate to avoid delays.

- Next, review the sections that pertain to your tax situation. Depending on the context of your filing, fill in the relevant details regarding income and deductions as necessary.

- Carefully read through the instructions provided on the form. Each section may have specific requirements, so it is crucial to understand what information is needed.

- If applicable, provide any additional documentation or information required to support your claims. This may include previous tax returns or supporting financial documents.

- Once all fields are complete and checked for accuracy, you may choose to save your changes. You can download, print, or share the form as needed.

Get started with your Notice 746 online today to streamline your document management process.

To obtain tax amnesty online, begin by researching the specific programs available to you through the IRS. Filling out the correct online forms and providing the required documentation is key to a successful application. You may find useful information in Notice 746 that relates to online application processes, ensuring you are well-prepared.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.