Loading

Get Schedule O Form 5471 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule O Form 5471 2011 online

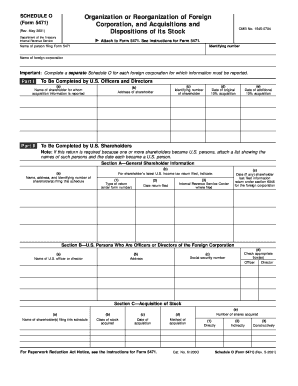

Filling out the Schedule O Form 5471 is essential for U.S. persons with interests in foreign corporations. This guide provides step-by-step instructions to help users effectively complete the form online, ensuring that all necessary information is accurately reported.

Follow the steps to complete the Schedule O Form 5471 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the person filing Form 5471 and their identifying number at the top of the form. Next, provide the name of the foreign corporation in the designated field.

- Complete Part I by providing the name, address, and identifying number of the shareholder for whom acquisition information is reported, as well as the dates of any original or additional acquisitions.

- In Part II, fill in Section A with the general information of the U.S. shareholder(s) filing the schedule, including their latest income tax return type and filing date.

- Continue in Section B by detailing U.S. persons who are officers or directors of the foreign corporation by listing their names, addresses, and social security numbers. Mark the appropriate boxes for their roles.

- Section C requires information about the acquisition of stock. For each shareholder, list the class of stock acquired, date of acquisition, and method of acquisition, along with the numbers of shares and amounts involved.

- In Section D, report any dispositions of stock, including the name of the shareholder disposing of stock, the class and date of disposition, and relevant amounts.

- Complete Section E with details about the organization or reorganization of the foreign corporation, including information on assets transferred and their values.

- In Section F, provide any additional relevant information regarding prior U.S. income tax returns, recent reorganizations, and ownership chain details.

- After entering all required fields, ensure accuracy, then save changes, download the form, print it for your records, or share it as needed.

Start filling out your Schedule O Form 5471 online today to ensure compliance and timely submission.

Yes, you can file Form 5471 electronically, which streamlines the process and helps ensure accuracy. However, you must use specific software that supports electronic filing for this form. By filing electronically, you can also receive quicker acknowledgments from the IRS. This convenience is especially beneficial for maintaining compliance with the Schedule O Form 5471 2011.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.