Get Form W-8imy (rev. December 2000). Certificate Of Foreign Intermediary, Foreign Partnership, Or

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form W-8IMY (Rev. December 2000). Certificate Of Foreign Intermediary, Foreign Partnership, Or online

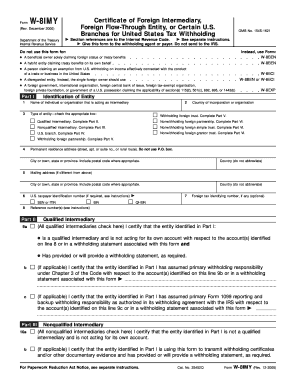

The Form W-8IMY is an important document used by foreign intermediaries, entities, and branches for U.S. tax withholding purposes. This guide will provide clear and supportive instructions on how to complete this form effectively.

Follow the steps to fill out the Form W-8IMY accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, provide the name of the individual or organization acting as the intermediary in Field 1. In Field 2, select the type of entity by checking the appropriate box, such as 'Qualified intermediary' or 'Nonwithholding foreign partnership'.

- Complete Field 4 with the permanent residence address, ensuring not to use a P.O. Box. Enter the city, state, and postal code accurately.

- If the mailing address differs from your permanent address, fill in Field 5 with the appropriate information for the country and city.

- Provide your U.S. taxpayer identification number in Field 6 if required; enter the foreign tax identifying number in Field 7 if applicable.

- In Part II, if applicable, check the box in Field 9a to certify as a qualified intermediary. Fill in any additional information requested in Fields 9b and 9c.

- For Part III, if you are a nonqualified intermediary, check Field 10a and provide necessary certifications in Field 10b as required.

- In Part IV, if applicable, certify the branch’s status in Field 11 and check either Box 12 or Box 13 as it pertains to your entity.

- In Part V, if identifying as a withholding foreign partnership or trust, complete Field 14 accordingly.

- In Part VI, check Field 15 if qualifying as a nonwithholding foreign partnership, simple trust, or grantor trust. Include necessary certifications.

- Finally, in Part VII, sign and date the form in the specified signature area, confirming the accuracy of the information provided.

- Once all sections are complete, save your changes, download, print, or share the completed form as needed.

Complete your forms online for efficiency and accuracy.

The W-8BEN form is specifically for non-U.S. individuals, while the W-8IMY form is tailored for foreign intermediaries or partnerships who manage multiple clients. This distinction is important as the W-8IMY allows for a more complex structure, enabling those intermediaries to receive payments on behalf of others. Knowing the differences ensures that you complete the correct form, like the Form W-8IMY (Rev. December 2000), Certificate Of Foreign Intermediary, Foreign Partnership, Or, for your specific situation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.