Loading

Get Irs Forms 8837

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Forms 8837 online

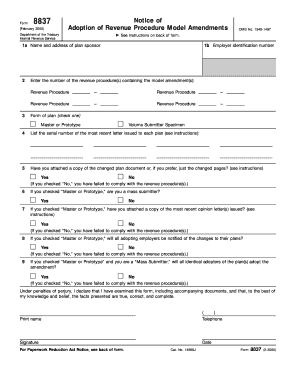

Filling out IRS Forms 8837 is an important step for plan sponsors who are adopting model amendments under revenue procedures. This guide provides clear, step-by-step instructions to assist users in accurately completing the form online.

Follow the steps to fill out the IRS Forms 8837 online.

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- In the first section, provide the name and address of the plan sponsor in the designated fields.

- Enter the employer identification number (EIN) in the specified area to ensure proper identification.

- List the revenue procedure numbers containing the model amendments you are adopting in the provided fields.

- Check the appropriate box to indicate the form of the plan: Master or Prototype, Volume Submitter Specimen.

- If applicable, list the serial number of the most recent letter issued to each plan, ensuring you follow any specific instructions related to this section.

- Indicate whether you have attached a copy of the changed plan document or just the changed pages by selecting 'Yes' or 'No'.

- If you are a mass submitter and checked 'Master or Prototype', confirm whether all adopting employers will be notified of changes to their plans.

- Complete the declaration section under penalties of perjury, including your printed name, telephone number, signature, and date.

- After completing all sections, save your changes, download, print, or share the form as needed.

Start filling out your IRS Forms 8837 online today to ensure compliance with the necessary procedures.

You can find the injured spouse form on the IRS website, typically listed as form 8379. Alternatively, for a simplified process, check out USLegalForms, which offers a user-friendly interface to easily access and complete various IRS forms, including the injured spouse form. This can save you time and help ensure accuracy in your submissions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.