Get 2000 Form 8824. Like-kind Exchanges

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2000 Form 8824. Like-Kind Exchanges online

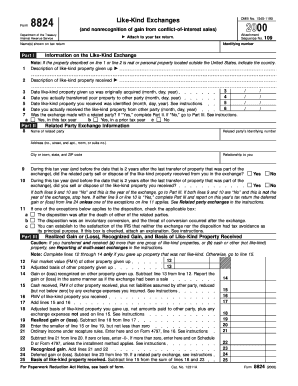

Form 8824 is essential for reporting Like-Kind Exchanges, allowing you to defer taxes on property exchanged for similar kinds. This guide provides clear, step-by-step instructions to help you navigate the form efficiently, ensuring accurate completion online.

Follow the steps to fill out Form 8824 accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In Part I, enter your basic information including the name(s) shown on your tax return and your identifying number.

- Provide descriptions of both the like-kind property you are giving up and the property you are receiving in lines 1 and 2.

- Fill in the dates relevant to your property transfer, including the date you acquired the property given up and the date you transferred the property.

- Complete the questions regarding whether the exchange involved a related party; answer appropriately and proceed to Part II if applicable.

- In Part II, include details about the related party, if any, along with the addresses and relationship to you.

- Address if the related party sold or disposed of the received property during the appropriate timeframe.

- Transition to Part III by calculating the realized gain or loss and the recognized gain, based on the property exchanged.

- Fill out necessary calculations for lines 12 through 25, ensuring all fair market values and adjusted bases are reported correctly.

- In Part IV, complete details about conflict-of-interest sales if applicable; include descriptions, sales prices, and costs for replacement properties.

- Finally, review all entries for accuracy before saving changes, downloading, or printing the form to submit.

Complete your Form 8824 today and ensure your Like-Kind Exchange is reported accurately online.

The 5 year rule for 1031 exchanges refers to the requirement that you must hold the replacement property for at least five years in order to benefit from certain tax deferments. If you sell the property before this period, the tax benefits may be revoked. This rule encourages longer-term investment strategies, aligning with your overall financial goals. Proper planning and understanding of this rule can maximize the efficacy of your investment strategies.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.