Get Fillable 2000 Form 8606

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable 2000 Form 8606 online

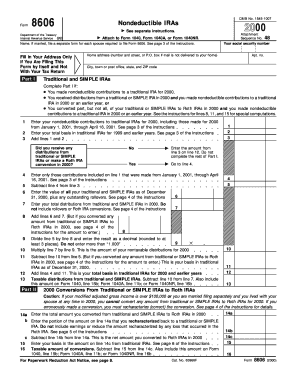

Filling out the Fillable 2000 Form 8606 online can seem daunting, but this guide provides clear and supportive instructions to help you navigate each section efficiently. This form is essential for reporting nondeductible contributions to traditional individual retirement accounts (IRAs) and for understanding distributions from Roth IRAs.

Follow the steps to successfully complete the Fillable 2000 Form 8606 online.

- Click ‘Get Form’ button to obtain the Fillable 2000 Form 8606, and open it in your editing tool.

- Begin by entering your name at the top of the form. If you are married, ensure that you complete a separate form for your partner as required.

- In the section for your social security number and address, provide accurate details, including your home address only if you are filing this form independently and not with your tax return.

- Move to Part I and complete the fields related to nondeductible contributions to traditional IRAs for the year 2000. Follow the prompts carefully, entering all contributions made until April 16, 2001.

- If you have received any distributions from traditional or SIMPLE IRAs or made a conversion to Roth IRAs in 2000, answer 'Yes' and continue with the required calculations in Part I.

- Proceed to Part II, if applicable, where you will report conversions from traditional or SIMPLE IRAs to Roth IRAs during 2000. Accurately fill in the details regarding conversions and recharacterizations.

- If you had any distributions from Roth IRAs, move to Part III. Here, provide the total distributions received in 2000 and any relevant basis information from previous years.

- For Part IV, if you received any distributions from Education IRAs, complete the relevant sections. Be mindful of contribution limits and the potential tax implications.

- After completing all necessary sections, review the form for accuracy. Ensure that all required fields are filled appropriately and that your calculations are correct.

- You can now save changes to your form, download it for your records, or print it out for submission. Ensure that you have all the necessary additional forms or documentation attached if required.

Ready to complete your documents online? Start now and ensure your forms are accurately filled out and submitted!

To fill out a PDF form, first open the document in a compatible PDF viewer that allows form completion. For example, the Fillable 2000 Form 8606 is designed for easy input of your information. You simply need to click on the fields, type your data, and save the form once satisfied with your entries.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.