Loading

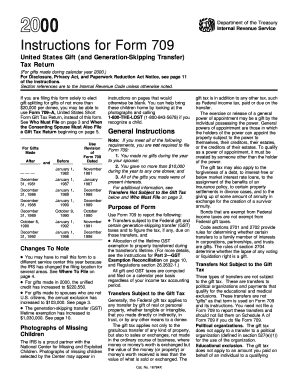

Get 2000 Form 709 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2000 Form 709 Instructions online

Filling out the 2000 Form 709 Instructions online can seem daunting, but with a structured approach, you can complete it efficiently. This guide offers step-by-step instructions to help you navigate each section and field with confidence.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the 2000 Form 709 and open it in your browser.

- Read the general instructions listed at the beginning to understand the purpose of the form and determine if you need to file.

- In the first section, provide your personal information including name, address, and identification numbers as required.

- Complete the 'Gifts Made' section detailing each gift you made, ensuring you include the description, value, and recipient information.

- For splits gifts between spouses, check the respective boxes and follow the provided instructions to ensure proper reporting.

- Move to Schedule A, where you will report the total gifts made, and allocate any relevant exemptions.

- Review each part to make sure all fields are accurately completed, correcting any potential errors.

- Once all sections are complete, save your changes. You can then download a copy of the completed form, print it or share electronically if needed.

Start filing your documents online today for easier management and submission.

Form 709 is filed as needed, specifically when an individual's gifts exceed the annual exclusion limit set by the IRS. This means it may not be filed every year, depending on your gift-giving activities. You can refer to the 2000 Form 709 Instructions for detailed information on when and how to file, ensuring you're compliant with tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.