Loading

Get Form 11c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 11c online

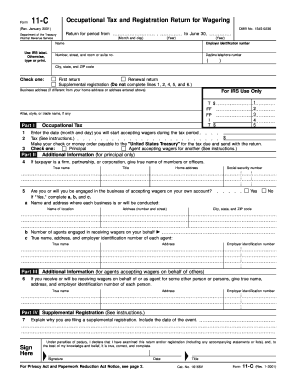

Filling out Form 11c online can streamline your registration process for occupational tax and wagering. This guide will walk you through each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to complete Form 11c successfully.

- Click ‘Get Form’ button to access the form and open it in your chosen online editor.

- Enter the return period by filling in the month, day, and year at the start and end of the period.

- If you are a first-time filer, check the box for 'First return'. If this is a renewal, check 'Renewal return', or select 'Supplemental registration' if applicable.

- In the section for the name, use an IRS label if available. If not, type or print the name clearly. Then, enter your employer identification number.

- Provide your address, including the number, street, and room or suite number, along with your daytime telephone number.

- Fill in the city, state, and ZIP code for your address. If your business address is different, enter that information as well.

- In Part I, enter the date when you intend to start accepting wagers. Then, indicate the appropriate tax amount based on when you start accepting wagers.

- Select whether you are a principal or an agent accepting wagers for another.

- In Part II, complete the additional information if you are a principal, including names and addresses of individuals in charge.

- If you are an agent, complete Part III with the necessary details about the principal on whose behalf you are accepting wagers.

- For supplemental registrations, explain the reason for filing in Part IV and provide details about any changes.

- Sign and date the form where indicated, confirming the accuracy of the information provided.

- Once completed, save your changes and choose to download, print, or share the form as required.

Take the next step and complete the Form 11c online to ensure your compliance with tax regulations.

C form is used to report the cancellation of debt. When a debt of $600 or more is forgiven or canceled, the creditor must file this form with the IRS and provide a copy to the debtor. It's essential for both parties to understand the tax implications of canceled debts. Using resources from uslegalforms can help make this process easier.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.