Loading

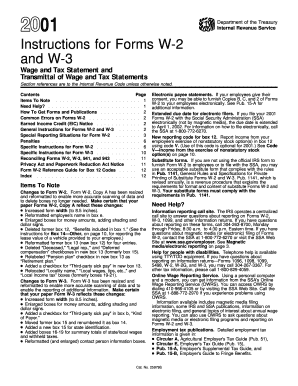

Get 2001 W 2 Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 W-2 fillable form online

This guide provides clear, step-by-step instructions for filling out the 2001 W-2 Fillable Form online. By following these guidelines, you can ensure that your form is completed accurately and submitted without issues.

Follow the steps to complete the 2001 W-2 Fillable Form online.

- Press the ‘Get Form’ button to access the 2001 W-2 Fillable Form. This will allow you to begin filling out the form in your online editor.

- Enter the employer identification number (EIN) in Box b. Ensure this matches the EIN used on your federal employment tax returns.

- Provide the employer's name, address, and ZIP code in Box c. This should correspond to the information on your tax filings.

- In Box d, enter the employee's social security number (SSN) exactly as it appears on their social security card. If the SSN is not available, enter 'Applied For'.

- Fill out the employee's name and address in Boxes e and f. Use the name as it appears on the social security card, including full details of the address.

- In Box 1, report the total wages, tips, and other compensation paid to the employee during the year before deductions.

- Complete Box 2 by entering the total federal income tax withheld from the employee's wages.

- In Box 3, enter the total wages that are subject to social security tax, excluding tips.

- Fill in Box 4 with the total social security tax withheld from the employee's wages.

- Complete Box 5 with the total Medicare wages. Include all wages subject to Medicare tax.

- In Box 6, enter the total Medicare tax withheld from the employee's wages.

- Fill in any applicable information in Boxes 7 through 20, depending on the employee's earnings and tax obligations.

- Review all entered information for accuracy to minimize errors that could lead to delays in processing.

- Once you complete the form, you can save changes, download the completed form, print it, or share it as needed.

Start filling out your 2001 W-2 Fillable Form online today!

To get a copy of your W-2 from two years ago, start by contacting your employer. They retain records of past W-2 forms and should be able to assist you. If you face difficulties, consider using services like US Legal Forms, which offers access to fillable forms, including older W-2s.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.