Get Form 5471 Schedule M

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5471 Schedule M online

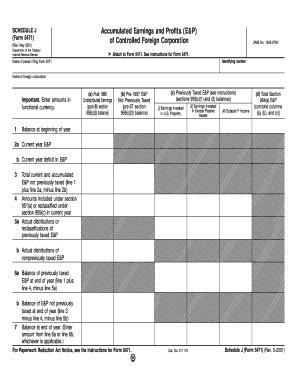

Form 5471 Schedule M is a crucial document for reporting accumulated earnings and profits (E&P) of controlled foreign corporations. This guide will provide step-by-step instructions on how to complete the form online, ensuring that you accurately report the necessary financial information.

Follow the steps to fill out Form 5471 Schedule M online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Section 1: Enter the identifying information. Start by filling in the identifying number, your name as the person filing Form 5471, and the name of the foreign corporation.

- Section 1: In column (a), report the post-1986 undistributed earnings. In column (b), provide the pre-1987 E&P not previously taxed. For column (c), detail the previously taxed E&P under the specified categories: (i) earnings invested in U.S. property, (ii) earnings invested in excess passive assets, and (iii) Subpart F income.

- Combine the totals from columns (a), (b), and (c) and enter the result in column (d) as the total Section 964(a) E&P.

- For line 2, enter the current year E&P in line 2a. If applicable, report any current year deficit in line 2b. Then calculate the total current and accumulated E&P not previously taxed by adding line 1 and line 2a and subtracting line 2b.

- On line 4, report any amounts included under section 951(a) or reclassified under section 959(c) for the current year.

- For line 5, provide the actual distributions or reclassifications of previously taxed E&P in line 5a and for nonpreviously taxed E&P in line 5b.

- Calculate the balance of previously taxed E&P at the end of the year on line 6a by adding line 1 and line 4, then subtracting line 5a. Similarly, for line 6b, calculate the balance of E&P not previously taxed by taking line 3 and subtracting lines 4 and 5b.

- On line 7, enter the appropriate balance at the end of the year; either from line 6a or line 6b, whichever is applicable.

- Review all entries for accuracy, then save changes. You may also download, print, or share the completed form as needed.

Complete your Form 5471 Schedule M online today to ensure compliance with reporting requirements.

You can find the instructions for Form 5471 on the IRS official website. The IRS provides detailed guidance on how to complete each section, including Schedule M, making it easier for you to understand your obligations. Additionally, you can explore resources like US Legal Forms, which offers templates and easy-to-follow guides. Utilizing these resources can help clarify any uncertainties you may have about filing Form 5471.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.