Loading

Get 2001 Form 4562

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 Form 4562 online

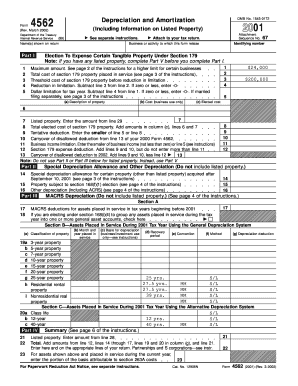

Filling out the 2001 Form 4562 online is a crucial step for individuals and businesses seeking to report depreciation and amortization effectively. This guide provides clear, step-by-step instructions to assist users through each section of the form.

Follow the steps to complete the 2001 Form 4562 efficiently.

- Click ‘Get Form’ button to access the form and open it in your preferred online document editor.

- Begin by entering the name(s) as shown on your return in the designated fields at the top of the form.

- Fill in your identifying number, which is typically your Social Security number or Employer Identification Number, as applicable.

- Provide the name of the business or activity related to this form, ensuring accuracy for tax reporting.

- In Part I, Section 179, enter the total cost of section 179 property placed in service. Follow the instructions carefully to determine the deduction limits based on your income and business type.

- For each listed property item, describe it accurately and enter the cost for business use. This includes details necessary for calculating depreciation.

- Proceed to Part II to report any special depreciation allowances. Ensure that all entries are supported by relevant documentation.

- In Part III, complete the required sections for MACRS depreciation if applicable, ensuring to categorize your assets correctly based on their recovery periods.

- For listed property, complete Part V, providing details on the business/investment use percentage and total mileage when required.

- In Part VI, if applicable, list any amortization details, including the description, dates, and amounts for costs incurred during the tax year.

- After completing all sections applicable to your situation, review your entries for accuracy.

- Once you are satisfied with the form, proceed to save changes, download, print, or share it as required.

Complete your documents online today to ensure accurate and efficient tax reporting.

Related links form

To calculate business income for the 2001 Form 4562, start with your gross income, then subtract allowable business expenses. Ensure you keep accurate records to substantiate your income claims. This calculation is vital for accurately reporting your financial performance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.