Get 2001 For 2441 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 For 2441 Form online

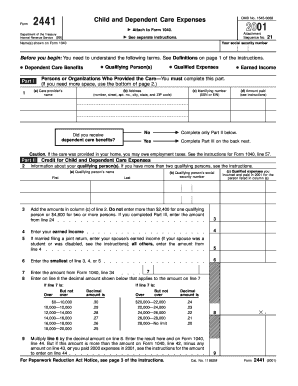

Filling out the 2001 For 2441 form online can streamline your experience in claiming child and dependent care expenses. This guide provides clear, step-by-step instructions tailored to your needs, ensuring that you can complete the form accurately and efficiently.

Follow the steps to fill out the form successfully

- Press the ‘Get Form’ button to access the form and open it in your preferred online editing platform.

- In the top section, input your name and social security number as shown on Form 1040. Make sure to enter this information accurately, as it will be used to process your application.

- Move to Part I, where you will enter details about the care provider. Fill in the care provider's name, address, identifying number (SSN or EIN), and the amount paid for the care services.

- Indicate whether you received dependent care benefits by selecting 'Yes' or 'No.' If you select 'Yes,' continue to Part III; otherwise, skip to Part II.

- In Part II, provide information about your qualifying persons. Include the name and social security number of each qualifying person, and document qualified expenses incurred.

- Calculate your earned income and your spouse’s earned income if applicable. Enter the smallest of the relevant lines from previous sections in the designated fields.

- Complete the calculations based on the provided decimal amounts for your qualified expenses, ensuring you do not exceed the specified limits for one or more qualifying persons.

- If applicable, continue to Part III where you will detail the dependent care benefits received, including any amount that was forfeited. Follow the instructions closely to calculate taxable benefits.

- After completing all relevant sections, review your entries for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Start filling out your 2001 For 2441 Form online today for a smoother filing experience.

Yes, the IRS may require proof of your child care expenses if you are filing the 20 Form. It’s important to keep receipts and any relevant documents that support your claims. While you don't need to submit this proof with your tax return, having it on hand ensures you can substantiate your claims if the IRS questions them. Platforms like US Legal Forms can help you understand what documentation might be necessary.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.