Loading

Get Form 940ez For 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 940ez For 2011 online

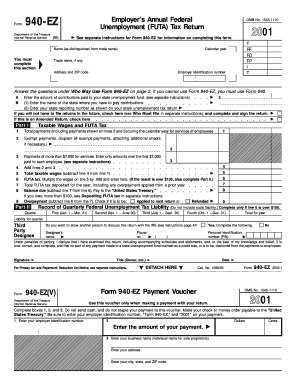

Filling out the Form 940ez for 2011 can seem daunting, but with the right guidance, it can be a straightforward process. This guide will take you step-by-step through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to fill out the Form 940ez online.

- Press the ‘Get Form’ button to access the form and open it in the editor.

- Begin by entering your name and trade name, if applicable, in the designated fields. Ensure that your name is clearly distinguished from your trade name.

- Provide your address and ZIP code as well as your employer identification number (EIN) in the specified sections.

- Answer the qualifying questions under 'Who May Use Form 940-EZ' to confirm your eligibility for this form.

- List the amount of contributions you have paid to your state unemployment fund in the indicated field.

- For Part I, report total payments made to employees during the calendar year in line 1. Note any exempt payments in line 2 and calculate the taxable wages in line 5.

- Complete line 6 by multiplying the taxable wages reported in line 5 by .008 to determine your FUTA tax.

- In Part II, if the FUTA tax amount (line 6) exceeds $100, complete the quarterly tax liability table by listing the tax liability for each quarter.

- Indicate if you would like to allow a third-party designee to discuss the return with the IRS by filling out the relevant fields.

- Sign and date the form, ensure all information is accurate, then save your changes, download, print, or share the form as needed.

Complete your Form 940ez online today for an efficient filing experience.

Schedule 2 for 2019 is an additional form used for reporting certain taxes that aren't covered in the standard return. It helps taxpayers account for additional tax obligations like unreported social security and other income. Using Form 940ez for 2011 can simplify tax processes, making it easier to understand your overall tax picture, including any additional liabilities reported on Schedule 2.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.