Loading

Get Irs 1999 706 Fill In Fillable Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs 1999 706 Fill In Fillable Form online

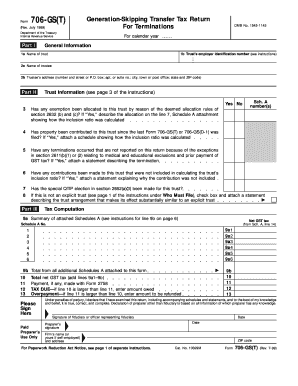

Filling out the Irs 1999 706 fill in fillable form online is an important task for individuals managing trusts subject to the generation-skipping transfer tax. This guide will walk you through the process step-by-step, ensuring you complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Begin with Part I by entering general information about the trust. Include the name of the trust, the trust’s employer identification number, the name and address of the trustee.

- Move on to Part II, where you will answer questions regarding trust information. Indicate if exemptions have been allocated to the trust, if any property has been contributed since the last return, and if any terminations or contributions not included in the inclusion ratio calculations have occurred.

- Fill out Part III, the tax computation section. Provide a summary of attached Schedules A, and make sure to calculate the total net GST tax based on the information provided in the schedules.

- Ensure all required attachments are included, including additional notes where necessary. This may include explanations for previous contributions or terminations.

- Conclude by signing the document. This section requires the signature of the fiduciary or the officer representing the fiduciary, along with their date of signing. If applicable, a preparer's signature along with their details must also be included.

- After reviewing all entries for accuracy, save your changes, and download, print, or share the form as needed.

Start filling out your documents online today for an easier, more efficient process.

To file the IRS 1999 706 fill in fillable form, first complete the form accurately, ensuring all required information is included. Next, sign and date the form before mailing it to the appropriate IRS address. Utilizing platforms like UsLegalForms can help streamline this process, offering guidance and templates to ensure accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.