Get Eftps Form 9787

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Eftps Form 9787 online

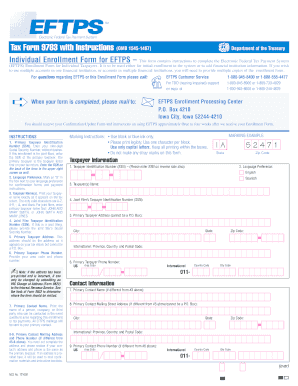

Completing the Eftps Form 9787 online is an essential process for individuals seeking to enroll in the Electronic Federal Tax Payment System. This guide will provide clear, step-by-step instructions to help users navigate each section of the form with confidence.

Follow the steps to fill out the Eftps Form 9787 online successfully

- To begin, click the ‘Get Form’ button to obtain the Eftps Form 9787 and open it in your preferred editor.

- Enter your nine-digit Social Security Number (SSN) in the Primary Taxpayer Identification Number section without any dashes. If you're enrolling as joint filers, include the primary taxpayer’s SSN.

- Mark your language preference for confirmation forms and payment instructions by placing an ‘X’ in the corresponding box.

- Print the taxpayer name exactly as it appears on your tax return in the Taxpayer Name(s) section, using allowed characters only.

- If applicable, provide the joint filer’s SSN in the Joint Filer Taxpayer Identification Number section.

- Input the primary taxpayer's address as it appears on the tax return, ensuring that it is not a P.O. Box.

- List the primary taxpayer's phone number with area code in the corresponding section.

- If your primary contact is different from the taxpayer, provide their name in the Primary Contact Name section.

- If necessary, fill in the Primary Contact Mailing Address and Phone Number sections according to the contact's details.

- Select your preferred payment method, marking EFTPS-Direct if you wish to direct the payment from your account.

- Indicate the input method(s) you will be using for EFTPS-Direct by checking the appropriate boxes.

- Optionally set a payment amount limit in the Tax Form Payment Amount Limits section to avoid overpayment.

- Enter the Routing Transit Number (RTN) for your financial institution, which can be verified with them.

- Fill in your account number in the Account Number section.

- Choose whether the account is Checking or Savings by marking the appropriate box.

- Provide the state and zip code of your financial institution using the two-character state abbreviation.

- Read and acknowledge the Authorization Agreement by completing the required information.

- Finally, sign and date the form where indicated, ensuring all necessary signatures are included before submitting.

Start filling out your Eftps Form 9787 online today and get your enrollment underway!

Yes, you can use the eFTPs Form 9787 to make your estimated tax payments. This form allows you to conveniently handle your tax obligations online, ensuring you stay compliant. Utilizing eFTPs simplifies the payment process and provides you with instant confirmations. For seamless management of your tax payments, consider using the uslegalforms platform, which offers guidance and resources on using eFTPs effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.