Loading

Get Form 4562 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4562 2002 online

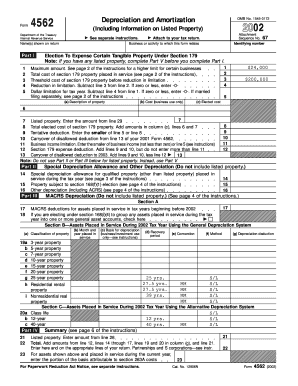

Filling out Form 4562 is an essential step in reporting depreciation and amortization for your business. This guide will provide clear, step-by-step instructions to help you complete the form accurately and conveniently online.

Follow the steps to successfully fill out Form 4562 online.

- Click 'Get Form' button to obtain the form and open it in your preferred editor.

- Complete the section for the name(s) shown on the return in the designated fields at the top of the form.

- Enter the identifying number in the appropriate field, which is typically your Social Security Number or Employer Identification Number.

- Fill in the business or activity related to the form in the specified area.

- Proceed to Part I to elect the expense for certain tangible property under Section 179, ensuring you reference the limits for this tax year.

- For each asset listed, provide a description, the total cost, and any elected costs as prompted.

- Continue through the subsequent parts of the form—Parts II, III, and V—filling out depreciation information for qualified property.

- Finally, review all entered information for accuracy, then save changes, download, print, or share the completed form as needed.

Start filling out your Form 4562 online today to ensure accurate reporting for your business.

If you neglect to file Form 4562 2002 when required, you may miss out on valuable deductions for depreciation and Section 179 expenses. This oversight could lead to higher taxable income and potential penalties. Filing this form is essential for compliant tax reporting, so take action to submit it when needed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.