Loading

Get Fillable Form 7004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fillable Form 7004 online

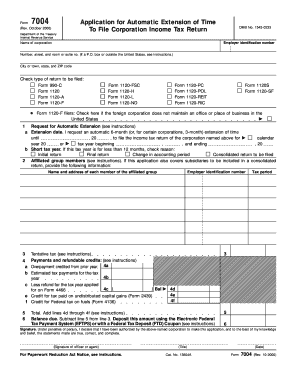

Filling out the Fillable Form 7004 online can be a straightforward process if you follow the right steps. This form is used to request an automatic extension of time to file a corporation income tax return, ensuring you meet your filing obligations without penalties.

Follow the steps to complete the Fillable Form 7004 online.

- Press the ‘Get Form’ button to access the Fillable Form 7004. This will allow you to obtain the form in a digital format that you can complete online.

- In the first section, provide the name of the corporation and its employer identification number. These details are crucial for identification purposes.

- Enter the corporation's address, including the street number, room or suite number, city or town, state, and ZIP code. If the address is outside the United States, ensure to include the country and follow its postal code format.

- Check the appropriate type of return to be filed from the listed options such as Form 1120 or Form 990-C. This determines the tax return that the extension applies to.

- For line 1a, select the extension date. You may request an additional six months or three months for specific corporations; do not select a date later than six months from the return's original due date.

- Complete line 1b if your tax year is less than 12 months, checking the appropriate reason for the short tax year.

- For line 2, provide the name and address of any affiliated group members if applicable, including their employer identification numbers.

- Input the tentative tax amount on line 3, reduced by any nonrefundable credits. This should reflect the tax shown on Form 1120.

- Detail any payments and refundable credits for lines 4a through 4f, ensuring to include any applicable write-in amounts.

- Calculate the total tax due by adding the line four amounts and record it on line 5.

- Enter the balance due on line 6, which is the amount the corporation is required to deposit.

- At the bottom of the form, an authorized individual must sign, date, and include their title. This signature affirms the truthfulness and accuracy of the application.

- Once the form is completed, you can save your changes. You may also choose to download, print, or share the form as needed, ensuring compliance with filing deadlines.

Complete your documents online today to ensure timely submissions and avoid penalties.

The modernized e-file MeF platform is an IRS initiative that streamlines the electronic filing process for tax forms. This system allows taxpayers to file forms directly over the internet in a secure environment. By using the Fillable Form 7004 with MeF, you can ensure your tax extension is submitted swiftly and successfully.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.