Get Form 5305 Simple 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5305 Simple 2002 online

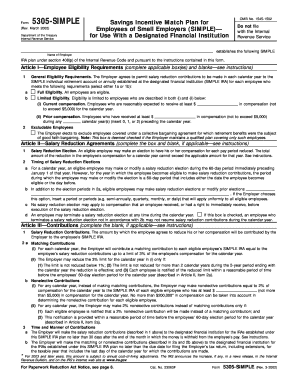

Filling out Form 5305 Simple 2002 is an essential step for employers looking to establish a SIMPLE IRA plan. This guide provides a clear, step-by-step approach to completing the form online, ensuring you have the necessary information and support for a successful submission.

Follow the steps to complete the Form 5305 Simple 2002 online effectively.

- Press the ‘Get Form’ button to acquire the document and open it in your preferred editor.

- Enter the name of your organization in the designated area. Ensure the name matches your official business records to avoid discrepancies.

- In Article I, select the eligibility requirements for employees. You can choose either 'Full Eligibility' or 'Limited Eligibility' based on compensation criteria specified in the form.

- Complete the exclusions in Article I for any employees covered by a collective bargaining agreement, if applicable.

- In Article II, indicate the salary reduction election for employees. Specify the percentage or amount of compensation that will be contributed to the SIMPLE IRA.

- Detail the contribution structure in Article III. Choose between matching contributions or nonelective contributions, confirming the limits set within the form.

- Specify the time and manner of contributions to the SIMPLE IRA in Article III. Ensure these details align with your payroll schedule.

- In Article IV, review the vesting requirements and other provisions to confirm understanding and compliance with requirements.

- Fill out Article VII with the effective date of the plan and provide signatures from both the employer and designated financial institution.

- Once completed, save your changes, and choose to download, print, or share the filled form as needed.

Complete your documents online now to streamline the establishment of your SIMPLE IRA plan.

The main distinction between Form 5304 SIMPLE and Form 5305 SIMPLE lies in their contribution matching rules. The 5304 allows employers to choose how they match contributions, while the 5305 requires specific matching contributions from employers. Understanding these differences through the lenses of Form 5305 Simple 2002 can help you navigate your retirement plan selections effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.