Loading

Get Form 4782

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4782 online

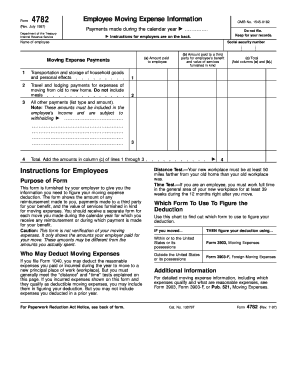

Form 4782 is an essential document for employees receiving reimbursements for moving expenses. This guide will assist you in accurately completing the form online, ensuring you understand each section and its requirements.

Follow the steps to successfully complete Form 4782 online.

- Use the ‘Get Form’ button to access the Form 4782. This will allow you to obtain the document and open it for editing.

- Begin by entering the name of the employee in the designated field, ensuring it matches the official name on their identification.

- Input the employee’s Social Security number in the corresponding field, ensuring accuracy to avoid discrepancies.

- In column (a), report the amounts paid to the employee for moving expenses, entering amounts for transportation, storage, and personal effects.

- For column (b), list any payments made to a third party for the employee’s benefit, along with the value of services provided in kind.

- Calculate the total for column (c) by adding the amounts in columns (a) and (b) for each line item.

- Document any additional payments in the section labeled 'All other payments (list type and amount)' ensuring they are included in the employee’s income.

- At the end of the form, sum the amounts in column (c) from lines 1 through 3 to obtain the overall total.

- Once all fields are accurately filled, save your changes, and download or print the completed form for your records.

Complete your Forms online efficiently to ensure accurate reporting of moving expenses.

To file an AR-11 form online, visit the USCIS website and find the specific instructions for electronic submission. Ensure you have your information ready, as the online form will request data regarding your residency. For comprehensive guidance, refer to Form 4782, as it can assist you in understanding the filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.