Loading

Get Form 1914

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1914 online

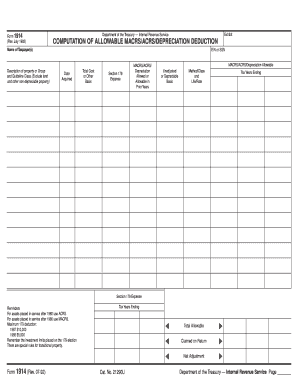

Form 1914 is an essential document for taxpayers to compute allowable deductions for MACRS, ACRS, and depreciation. This guide will provide you with step-by-step instructions to help you complete this form efficiently online.

Follow the steps to fill out Form 1914 accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the name of the taxpayer(s). This could be an individual or a business entity.

- Next, describe the property or group related to the assets. You must also include the guideline class, omitting any non-depreciable properties, such as land.

- Provide the Employer Identification Number (EIN) or Social Security Number (SSN) of the taxpayer.

- Fill in the acquisition date of the property in the specified field.

- Input the total cost or other basis of the property to reflect the investment made.

- If applicable, specify the Section 179 expense claimed on the property.

- Indicate the depreciation allowed or allowable from prior years. This includes any MACRS or ACRS deductions previously claimed.

- Next, indicate the MACRS/ACRS depreciation allowable based on the unadjusted or depreciable basis of the asset.

- Then, select the appropriate method/class and life/rate for the asset in question.

- Input the tax years ending for which you are calculating the depreciation.

- Lastly, review the form for any net adjustments and the total allowable deductions before saving changes, downloading, printing, or sharing the form.

Complete your Form 1914 online today for accurate depreciation calculations!

To acquire the 1904 form, you can download it directly from the BIR's official website. Alternatively, you can find it on legal resource sites like UsLegalForms. Easily search for 'Form 1914' to ensure you get the precise form you need for your tax reporting.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.