Loading

Get 5305sep Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 5305sep form online

Filling out the 5305sep form online can be a straightforward process if you follow the appropriate steps. This guide is designed to help users navigate each section of the form with clarity and confidence.

Follow the steps to complete the 5305sep form online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by providing the name of the employer in the designated field. Ensure that the name is accurately entered as it will identify the SEP agreement.

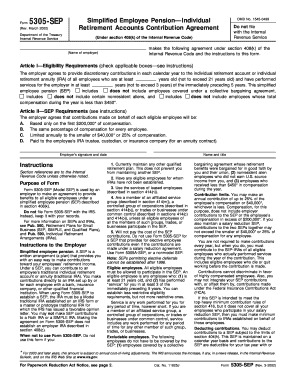

- Proceed to Article I—Eligibility Requirements. Check the applicable boxes regarding employee age, service duration, and any exclusions that apply to collective bargaining agreements or compensation limits.

- Next, move to Article II—SEP Requirements. Specify the contribution bases, percentages, and limits on contributions that will apply to the eligible employees.

- Sign and date the form in the designated section, confirming your agreement to the terms stated in the form.

- After completing all the sections, review your entries to ensure all information is accurate and complete.

- Finally, save your changes, download the form, and choose to print or share it as needed, while ensuring that this document is retained for your records.

Complete your 5305sep form online to secure a simplified employee pension for your employees.

To file IRA contributions, include the contributions on your tax return using IRS Form 1040 and ensure that you report them on the appropriate schedules. If you're self-employed, you’ll likely detail these contributions on Schedule 1 or Schedule C. It's essential to keep records of all contributions made, including the use of the 5305sep Form for clarity and compliance. For an easier filing experience, explore USLegalForms for accurate templates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.