Loading

Get W7 Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W-7 Instructions online

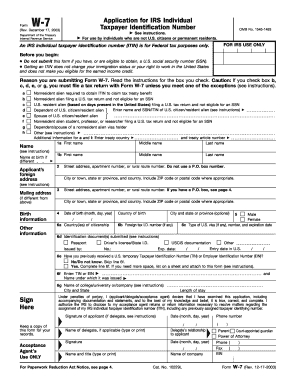

Filling out the W-7 Instructions online can seem overwhelming, but this guide will provide clear, step-by-step directions to help you navigate the process effectively. By following these instructions, you can ensure that your application for an IRS Individual Taxpayer Identification Number is completed accurately and submitted correctly.

Follow the steps to complete the W-7 Instructions online.

- Click the ‘Get Form’ button to obtain the W-7 form. This will open the form in an online editor, allowing you to fill it out digitally.

- Begin by checking the appropriate box that indicates your reason for submitting Form W-7. Review the options carefully to select the one that best applies to your situation.

- In section 1a, enter your full name exactly as it appears on your legal documents. If your name at birth differs, provide that in section 1b.

- Complete your foreign address in section 2, including the street address and postal code. Do not use a P.O. Box to avoid application rejection.

- In section 4, enter your date of birth in the specified month/day/year format, and the country where you were born.

- Specify your gender in section 5 by checking the appropriate box.

- If applicable, complete line 6 by entering your country of citizenship, tax identification number, visa information, and details of the identification documents you are submitting.

- Sign the form in the designated section and enter the date. If applicable, provide the name and relationship of any delegate who signs on your behalf.

- Review all the information for accuracy. Save the changes, and if necessary, download a copy for your records. You may then print or share the completed form as needed.

Start completing your W-7 Instructions online today to ensure timely processing of your application.

To fill out the income tax form, begin by entering your personal information accurately. If you need an ITIN, refer to the W7 instructions for guidance. Follow the form’s prompts to report your income, deductions, and credits. Ensure all information is accurate to avoid issues with your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.