Get 2002 Form 8867

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2002 Form 8867 online

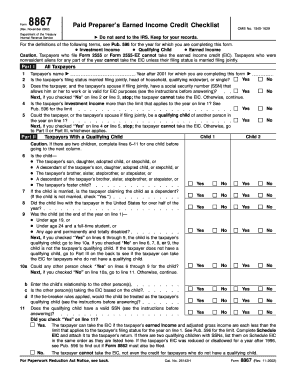

Filling out the 2002 Form 8867 is a crucial step for paid preparers to ensure due diligence in determining a taxpayer's eligibility for the earned income credit. This guide provides a comprehensive walkthrough of each section and field of the form, designed to support users with varied levels of experience.

Follow the steps to complete the 2002 Form 8867 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the taxpayer's name in the designated field. Ensure the name is accurate as it appears on their legal documents.

- Continue to Part II if the taxpayer has a qualifying child. For each child, answer the questions regarding their relationship to the taxpayer, residency, and age to confirm their status as a qualifying child.

- Once all relevant sections are filled out thoroughly, review the form for accuracy. Save your changes, and download, print, or share the completed form as needed.

Complete the necessary documents online to stay compliant and ensure accurate reporting.

Various tax forms are sent to the IRS, including the 2002 Form 8867, income tax return forms like Form 1040, and various schedules for deductions and credits. It is important to submit all relevant forms to ensure that your tax return is complete and accurate. Using a dependable service like US Legal Forms can help you gather and organize all necessary forms to simplify the tax filing process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.