Loading

Get Irs Form 8863 2004 Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 8863 2004 Online online

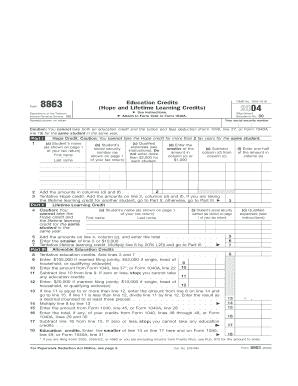

Filling out the Irs Form 8863 2004 online is essential for claiming education credits that can help reduce your tax liability. This guide provides step-by-step instructions to assist users in accurately completing the form.

Follow the steps to successfully complete the Irs Form 8863 2004 Online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name and social security number as indicated at the beginning of the form. Ensure the details match those on your tax return.

- In Part I, you will need to provide details for each student qualifying for the Hope credit. Fill in the student's name, social security number, and the qualified expenses paid in 2004.

- Calculate the amount eligible for the Hope credit by entering the smaller of the qualified expenses or $2,000 for each student.

- Add the amounts calculated and proceed to Part II for the Lifetime Learning credit if applicable. Here, enter similar details for students eligible for this credit.

- After completing both parts, total the entries from each section to figure your allowable education credits in Part III.

- Finally, review the entire form for accuracy, save your changes, and choose to download, print, or share your completed Irs Form 8863 2004 online.

Complete your Irs Form 8863 2004 Online today for potential tax savings!

Related links form

Accessing IRS Form 8863 2004 Online is straightforward. You can visit the IRS website or use platforms like uslegalforms that provide direct links to the form. Additionally, many tax preparation software options include this form, allowing you to fill it out digitally. Once you find it, ensure you download the form and review it for completion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.